Gallup community central to music-store owner

Courtesy photo

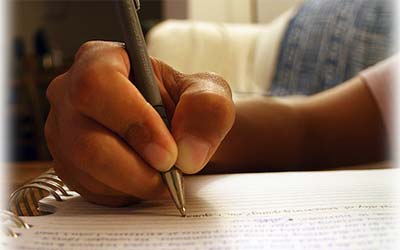

Quintana’s Music Center in Gallup is located on Coal Avenue in the heart of the city’s revitalized downtown.

By Holly Bradshaw-Eakes

Finance New Mexico project

GALLUP

Rhonda and Ryan Quintana connected over music.

Born and raised in Gallup, both were active in the local music scene — Rhonda as a singer and Ryan playing guitar while pursuing a music degree.

It was no surprise, then, when Rhonda and Ryan opened Quintana’s Music Center in 2017 on Gallup’s Coal Avenue in the heart of the city’s revitalized downtown.

The store sells musical instruments and band equipment, and the Quintanas work with schools to help students get the instruments they need.

Rhonda said dedication to community is central to what they do. Before the pandemic, Rhonda served on various boards, led fundraising efforts for local charities, and provided management and logistics for community-energizing local events through the business.

“We try really hard to be ingrained in our community,” Rhonda said.

Stocking a music shop requires substantial investment.

“You can’t just fill out an application and then buy $100 worth of Fender guitars,” Rhonda said. “You have to buy $20,000 worth of equipment upfront.”

At the suggestion of the Small Business Development Center, the Quintanas turned to the Rural Community Assistance Corporation for a loan that would help them purchase the inventory needed to launch the store.

RCAC is a community development financial institution that offers loans and lines of credit to businesses in rural communities. The nonprofit organization provides training, technical assistance, financial resources, and advocacy that fill gaps in communities with populations under 50,000.

Barely two years after starting the business, the coronavirus pandemic closed in, shuttering schools, canceling community events, and locking the doors of stores like Quintana’s Music Center.

With their revenue tied to education, events and retail, the pandemic was a triple blow to the Quintanas.

“We had to rethink our business model,” said Rhonda. “It was a really hard time for us.”

Rhonda quickly learned how to create a website for an online store and set up social media accounts to let customers know when instruments and equipment could be picked up curbside.

Surrounded by the Navajo Nation, which suffered overwhelming losses due to COVID-19, the store went beyond mandated safety protocols.

RCAC’s Georgianne McConnell helped Rhonda identify state and federal financial resources that were available to businesses closed by the pandemic. She also offered a new loan to help the business recover.

RCAC’s Re-emerging Loan Fund (RELieF) was created to help rural businesses reemerge into the marketplace after pandemic restrictions were lifted.

The loan offers up to $25,000, along with technical assistance and coaching, to businesses impacted by the pandemic. A one-time $250 processing fee can be included in the financing, which carries simple interest of 3 percent, with the possibility of deferred payments.

RELieF loans may be partially or fully forgiven based on circumstances or need.

Rhonda called the coaching and technical assistance invaluable.

“They really help you look at your bottom line and give suggestions on things that you could do to help your cash flow increase,” Rhonda said.

Georgianne checked in frequently, providing help with projections and profit and loss statements.

“She was just so supportive, and I never felt pressured,” Rhonda said. “She was more like a mentor than anything.”

Rhonda credits the community with the survival of Quintana’s Music Center.

“We were so fortunate about how loyal the Navajo Nation was to Quintana’s Music and lucky to have so many musical people in our community really going above and beyond to try to make sure that we didn’t have to close our doors for good,” she said.

Information: https://www.quintanasmusiccenter.com/ and https://www.rcac.org/lending/re-emerging-loan-fund/

Highway 264,

Highway 264, I-40, WB @ Winslow

I-40, WB @ Winslow